The most popular tax saving investment options available to individuals and HUFs in India are under Section 80C of the Income Tax Act, Section 80C includes various investments and expenses you can claim deductions on – up to the limit of Rs. 1.5 lakh in a financial year.

Tax

SavingInvestment

We integrate tax-saving investment strategies into our internal capital management process—leveraging tax-efficient instruments to preserve income and enhance long-term returns. While we don’t offer personalized plans to others, our in-house models are designed around the principles of financial efficiency and compliance.

The best time to start planning your tax saving investments is at the beginning of the financial year.

Most taxpayers procrastinate till the last quarter of the year, resulting in hurried decisions. Instead, if you plan at the start of the year, your investments can compound and help you achieve long-term goals.

Remember, tax saving should be an additional perk and not a goal in itself.

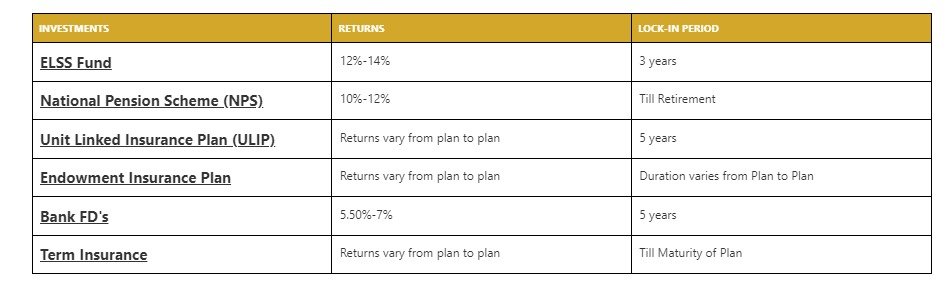

Investment optionsunder Sec 80C

Comprehensive End-to-End Investment Management

Detailed Analysis

Unique investment opportunities qualified through rigorous due diligence

Complete Transparency

Disclosure of all aspects of each investment, terms of lease and potential risks

Reputed Co-Investors

Required investors invest at least 30% of the total investment amount for each asset

Seamless Process

Investment identification, execution and management delivered at your fingertips by our expert advisors

Other Tax Saving Investment options beyond Sec 80C

Apart from the 80C deductions, there are various deductions under Section 80 you can use to save on income tax. Tax benefits on health insurance premiums and home loan interest are a few-

- Medical insurance premium to be claimed at Rs. 50,000. (Rs 25000 for self spouse and children and Rs 25000 for dependent parents below 60 years). Claim medical insurance premium paid up to a maximum of Rs 1,00,000 per annum if availed for senior citizens. If senior citizens are not covered under any health insurance, then medical expenditure incurred can be claimed under 80D up to Rs 50,000

- Interest paid on a home loan can be claimed as a deduction under section 24 up to Rs 2 lakhs. Section 80EE also allows you to claim a deduction of up to Rs 50,000 on home loan interest which is over and above the limit of section 24. Eligibility of additional interest of Rs 1.5 lakh on purchase of a new house under affordable housing scheme as per section 80EEA is extended till 31st March 2022

- A home loan would also help you in reducing your taxable income as the principal portion of the home loan can be claimed under Section 80C up to Rs 1.5 lakh and the interest portion can be claimed as a deduction from income from house property

- Any charity to notified institutions or funds can be claimed as a deduction under section 80G